Influences of Part D in MAPD and Standalone Coverage Study

Available: February 13, 2026

Available: February 13, 2026

In 2025, we learned just how influential the Part D component can be for MAPD consumers as prescription habits shifted under the protection of a $2,000 MOOP. With negotiated drugs in play for 2026, how are seniors likely to respond to cost increases and design changes (up-tiering, copay to coinsurance, etc.) as carriers grapple with high drug spend against the rise of the $0 premium Part D plan? In this study, we’ll glean how the tiered placement of specific, common medications influences MAPD and Part D consumerism.

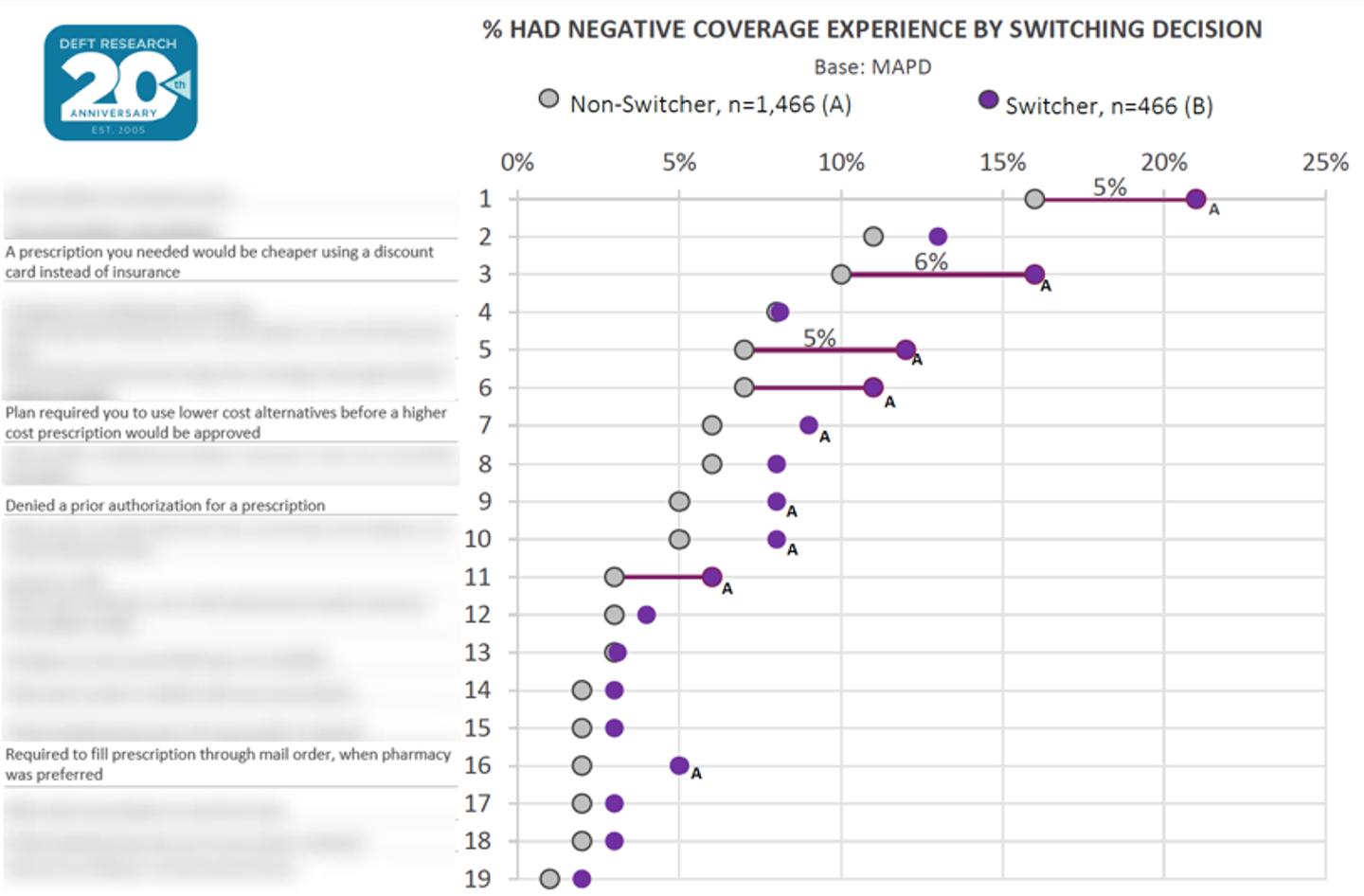

Negative Drug Experiences Driving MAPD Switching

Negative drug coverage experiences strongly impacted MAPD seniors’ decisions to shop and switch plans during the last AEP. The most significant issue was that switchers were much more likely than non-switchers to find prescriptions cheaper with a discount card—a gap that was even wider for those with standalone Part D coverage. Given recent disruptions, more seniors may switch plans in 2026 if they see greater value in discount cards than in their Part D benefits. Stakeholders should ensure deductible structures don’t drive seniors away from Part D.