Nothing beats conjoint analysis when it comes to building products with a consumer-centered approach. Conjoint analysis allows a comparison of how consumers value whole products as well as each attribute of the products. With these measures, health benefit designers can estimate the appeal of products, their relative share of preference, and the trade-offs in premiums and cost sharing consumers are willing to make.

So it is exciting that the methodology for this gold standard continues to evolve.

An emerging addition to our product research tool kit is called “Adaptive Choice-based Conjoint” or ACBC. ACBC has been developed to account for the fact that people don’t come to their shopping tasks with a blank slate. Consumers assessing health insurance options have guardrails in mind that dictate their ‘must-haves’ and ‘will-not-accept’ product attributes. For instance, going into the shopping process some consumers consider an HMO network unacceptable, others may find a non-$0 premium unacceptable. Still others may consider the richest dental benefits or coverage of chiropractors “must-haves”. In short, when faced with a complex decision, consumers create ways to simplify it — guardrails narrow down the choices that need to be considered.

An ACBC conjoint identifies which attributes consumers ‘will-not-accept’. The study requires a longer survey but, respondents find it more engaging. This is because, once they are identified, unacceptable attribute levels are excluded from the rest of the survey. Excluding attribute levels that aren’t interesting improves the consumer’s sense of relevance and willingness to do the survey, thereby improving data quality.

ACBC’s design acknowledges that consumers have pre-existing guardrails and identifies them so that the attributes that are, in the mind of the consumer, acceptable are more precisely evaluated.

Demonstration — National Medicare Advantage Supplemental Benefits Conjoint Study

In January, Deft published the National Medicare Advantage Supplemental Benefits Conjoint Study a national study using ACBC. In this study, online respondents were taken through a screening task in which they were shown Medicare Advantage products containing supplemental benefits and asked to indicate whether each product is a possibility they’d consider or not. This screening stage identified the attributes each respondent consistently avoided (their ‘will-not-accept’) attributes, and the ones they consistently included in their choices (their ‘must-haves’).

In the next stage of the survey, respondents were shown health benefit choices as is done in a traditional conjoint study. But the products shown were calibrated to their preferences that were determined in the previous screening task. An additional enhancement of the study is that whenever the benefit levels presented are the same across all choices, they are grayed out by the software. This encourages the respondent by supporting their focus on the aspects of the choice that are different and interesting.

A Glimpse at Study Results

The National Medicare Supplemental Benefits Conjoint Study provides easily understood yet nuanced detail on the market for Medicare benefits.

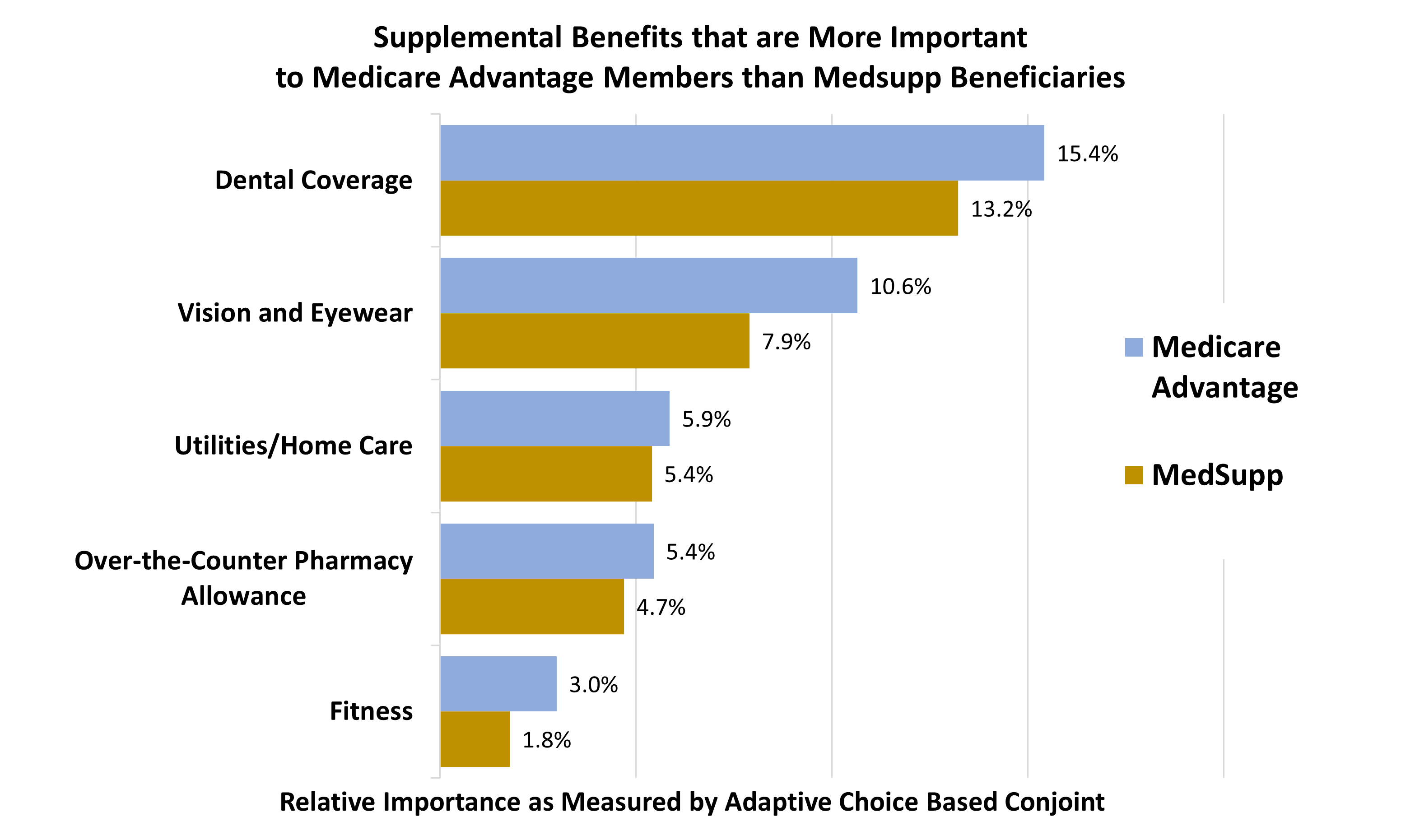

The study includes Age-ins, Medsupp beneficiaries, those with original Medicare only, and Medicare Advantage (MA) members. Below we see evidence that, compared to MedSupp seniors, MA members place higher importance on a variety of supplemental benefits .

The graph above shows that the importance of supplemental benefits is greater among an MAPD population than among a Medsupp population. But the study also discusses how price sensitivity qualifies the uptake of these valued benefits. It found that, compared to the other groups, MA members were more sensitive to premium levels. For example, even though dental benefits are important, MA members were not as willing as other groups to pay higher premiums to obtain richer coverage.

Only conjoint analysis allows product developers to actually measure the impact of coverage levels for each benefit, and for packages of combined benefits, within a range of prices.