Medicare Age-In Study

Available: May 30, 2025

Available: May 30, 2025

Employer Group Retiree plans are on the decline. Yet despite 2024’s MA switching spike, recent total AEP switching has generally hovered at 13 percent or less. With over four million 64 year-olds on the cusp of Medicare eligibility today, now is the time for engaging those consumers are around age 65 and transitioning from Commercial to Medicare coverage.

Our Medicare Age-In Study is widely considered the “gold standard” assessment of how Commercial Group, ACA, Medicaid, and the uninsured navigate their journey into Medicare. With this research in hand, industry insiders can better understand the ideal cadence of touchpoints, messaging themes, and enrollment preferences that boomers seek when considering Medicare Supplemental or Medicare Advantage coverage for the first time.

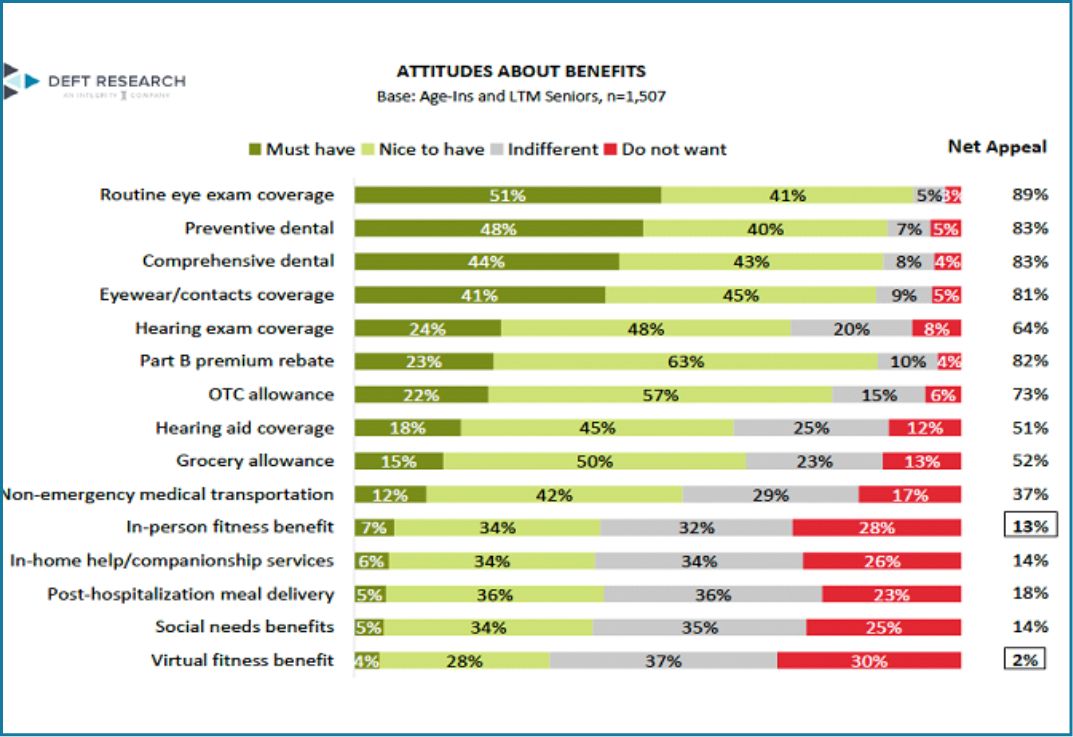

Selecting “Must-Have” Benefits

Around half of seniors indicate vision and dental coverage are “must have” aspects of coverage (see chart). And when netting out those who do not want these benefits from those who do, vision garners between 81–89% net appeal, while dental gets 83%. The message to MA managers is clear: “Hands off my dental and vision.” But deciding which benefit (or benefits) to sacrifice is never as easy as it seems.

MA or MedSupp?

Of those leaning toward MA, almost a quarter report they are still considering MedSupp, with an additional 56% being at least open to the idea.

The Draw of Dental Coverage

Plans with more comprehensive dental coverage appeal strongly to Age-Ins with worse financial outlooks, as they indicated they would allocate nearly twice as much to dentures or dental implants compared to those with better outlooks.